How Getting Invoices Paid Online Improves Cash Flow

Steady, reliable cash flow is crucial for the survival of any small business – so taking steps to ensure your customers pay promptly should be a key priority.

There are many tools and strategies you can use that will help improve your cash flow right away. Some steps are pretty simple and easy to implement whilst others are a bit more strategic and techy.

Take for example online accounting systems: In the year through to September 2018, the subscribers to XERO have grown by 27%. One of the reasons for this increase is that business owners realise that making account payment processes easier for clients decreases the time required to manage Accounts Receivable. That’s good for cash flow and good for business!

If you are still using bookkeeping programs that are installed on your hard drive and are not talking to your online banking system or your new job flow system, you’ll soon be left spending more time doing your business admin than time spent making money.

If you’re experiencing the ‘cash flow blues’ and need some help to get back on track, you can contact us directly and we can conduct a FREE Cash Flow Pulse Check for you. And while we’re at it we can also advise you on the best online accounting system options for you based on your current set up.

Now let’s look at the 3 most important things that will help you avoid the ‘cash flow blues’.

1. Tell your customers how and when to pay

Start by telling your customers upfront what your payment terms are. Clearly state your rates, payment due dates, and policies for late payment – including any fees incurred on balances owing.

Always provide your terms in writing so that there can be no misunderstanding. Include payment terms as a standard item of information when you prepare an estimate or quote for a new client.

Here are some suggestions to help incentivise early payments or punish late payments. The carrot-and-stick approach can work wonders in managing Accounts Receivable.

Reward early payers

Consider offering customers a 2% discount when they pay their invoice within ten days. In this scenario, a $1000 invoice would be reduced to $980 – not a huge loss for you, but an attractive cash-saving incentive for your customers.

Charge interest

As part of your terms, specify that if a client’s payment is past due, a weekly fee of 2% will be added onto the total until funds are received in full.

Get paid upfront

Collect a partial deposit – or the entire amount in full – before you provide a product or service to your customers.

Reduce terms

Net 30 payment terms are fairly standard in business, but there’s nothing stopping you from asking for payment sooner. Some business owners make payment due at Net 7 or 10; others stipulate payment is due upon receipt of invoice.

Suspend service

Stop your supply of products or services until you receive payment. With this tactic you’ll avoid the accumulation of an even greater loss with a consistently late or non-paying client.

2. Invoice as soon as you’ve finished the job

Depending on how far you’ve gone down the path of moving your financial administration online, invoicing immediately can be either a breeze or a hassle. In order to invoice for a service or job immediately you’ll need to have mobile, integrated accounting systems.

Imagine you went out to do a job at a house, let’s say you’re there to do a plumbing job. Wouldn’t it be great if you could prepare an invoice on the spot AND get it paid by the customer right away? This is not pie-in-the-sky stuff, tradies are actually working like this already.

You can also use job flow systems that can be integrated with your accounting system, so that all you have to do after completing the job is take 10 more minutes and prepare your documents on your mobile or tablet. Beats going back to the office and doing it all manually on hard drive programs.

3. Make invoice payment as easy as buying milk

The cashless society is making more and more in-roads. Writing cheques are almost a thing of the past, unless you want to purchase a car or other major item… and then it’s a bank cheque that’s required.

Not only can cloud-based accounting systems integrate with your online banking, they can also integrate with online payment gateways like Paypal or Stripe. Payment gateways allow you to take payment using the client’s credit card details right there, on the spot, and without the need for an expensive merchant facility.

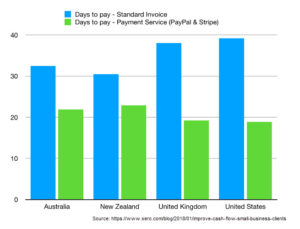

The graphic below shows that in Australia and New Zealand, PayPal and Stripe invoices get paid up to 10 days faster, on average, than with standard invoicing.

If you’re currently preparing your invoices manually, switch over to an accounting system with automated billing. That way you can create recurring invoices for clients who are being charged the same amount regularly.

You’ll never forget to invoice a client, and you’ll eliminate errors as you save time. The first time a client is billed make sure the contact information on your invoice is complete to avoid delays with processing.

Follow up

Call your customer immediately when a payment is past due. Ask for the status of the invoice and if there’s anything you can do to speed up payment. Sometimes a simple change, like including a purchase order number on the invoice, can speed up processing.

Stay on top of Accounts Receivable

Monitor your accounts receivable on a weekly basis so you can act fast if a customer hasn’t paid on time. An AR aging report can help you easily track outstanding invoices right in your accounting software – or create an Excel report you can track manually, if you prefer.

Copyright © TradieBookkeepingSolutions.com.au All Rights Reserved.